View as PDF

Chicago – For nearly a decade, Taxpayers United of America (TUA) has played a critical role in publicizing the government pension crisis that has developed around the country and particularly in Illinois, where TUA was founded and currently based. With the shifting political climate in the state and the election of Republican Gov. Bruce Rauner last November, who has stirred up the political class by taking a hardline approach to solving the government pension debacle without raising taxes, taxpayers are seeing more favorable news coverage opposing the lavish government pension system than ever before.

In the last week alone, TUA has received very favorable news coverage by WBBM Newsradio, Sauk Valley News, Michigan Capitol Confidential, and even the Chicago Tribune. Every bit of news coverage for TUA and the government pensions means that exponentially more taxpayers are becoming informed of the perilous financial situation that their politicians have put them in.

The gold-plated government pensions are a hot issue in Illinois and across the country, especially as legislators scramble to temporarily plug budget holes before they adjourn to their communities. These are the same bureaucrats who promise tax relief to their constituents while continuing to perpetuate a broken government pension system by balancing the books on the backs of taxpayers. TUA is here to set the record straight.

And that is why TUA’s work is so vitally important to taxpayers. Over the last decade, TUA has forced the Illinois government pension fiasco into the spotlight and for good reason; the current government pension system is unsustainable. With our persistent activism and outreach, TUA’s website is flooded daily by waves of taxpayers looking to become members, joining TUA in the fight for fiscal sanity in Illinois and to reclaim our economic future.

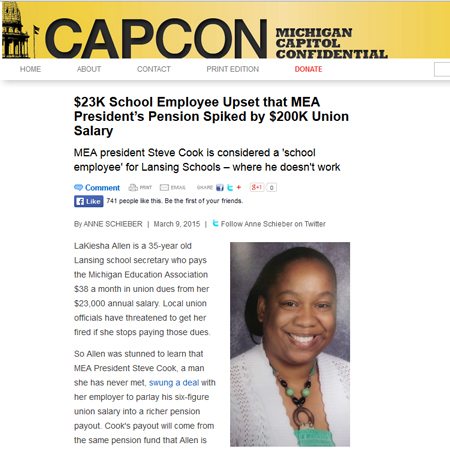

Taxpayers United of America’s Rae Ann McNeilly was quoted by CAPCON on an article about MEA president Steve Cook being considered a ‘school employee’ for Lansing Schools – where he doesn’t work.

LaKiesha Allen is a 35-year old Lansing school secretary who pays the Michigan Education Association $38 a month in union dues from her $23,000 annual salary. Local union officials have threatened to get her fired if she stops paying those dues.

So Allen was stunned to learn that MEA President Steve Cook, a man she has never met, swung a deal with her employer to parlay his six-figure union salary into a richer pension payout. Cook’s payout will come from the same pension fund that Allen is counting on for her own retirement – a fund that is currently underfunded by nearly $26  billion.

billion.

“It terrifies me,” Allen said. “And if others knew what was going on, I’m sure they’d be frightened, too. Secretaries are severely unpaid. We, the working class, are the ones who are going to suffer behind the Steve Cooks of the world and the school district for allowing this to happen.”

Allen said she is hardly surprised by the deal. Her observation is that the administration and union look out for their own interests ahead of district employees and schoolchildren. She enjoys her job as a secretary in an elementary school, but her relationships with the Lansing School District and union have been troubled. Allen endured recrimination and what she describes as outright hostility that forced her, at one point, to take time off to recover from stress.

Allen started working at the school district in 2010 after working as a church secretary. In 2011, due to budget cutbacks and her low rung on the seniority list, she was laid off. She was recalled three months later but not to the same job. The district offered her a “2.5” secretarial position in which she would get full-time hours by splitting her day between two different schools. District officials told her she would be first in line when a one-location job became available.

That’s not what happened, though. A few months later, Allen learned that an acquaintance of hers with less seniority was given a one-location job. As it turned out, her acquaintance preferred a split shift because it would allow her to pick up her child in the middle of the day. The two employees approached the district about swapping jobs, to which it agreed – until the union stepped in.

“The union didn’t want to agree to it because they were afraid it would set a precedent. I told them there was nothing in the contract prohibiting us from switching, but they weren’t budging,” said Allen.

Allen prevailed and made the switch, but the union wasn’t done. It and the district inserted a clause into the next union contract, prohibiting switches without union approval. A short time later, she said, the reprisals began.

Over the course of the next school year, Allen noticed that she seemed to be held to a different standard than others. Secretaries were allowed to listen to the radio in their offices but Allen says she was told gospel music was inappropriate.

Allen worked in the discipline-and-attendance office. Allen’s relationship with her boss deteriorated. She asked for a transfer and called on the union for help.

Allen said that at a subsequent grievance hearing it was hard to tell whose side the union was on.

“The union reps did more yelling at me than the school principals who were giving me such a hard time. When the meeting ended, I called the MEA office in tears, asking for better help,” Allen said.

Allen said the MEA promised her it would resolve the situation. The union appointed someone new to the case, but that person turned out to be equally unhelpful. Allen decided to deal with the district’s human resource office on her own and got her transfer after applying for the next secretarial job that opened up.

Allen began seriously questioning the union’s value. She says that since 2010, her dues have gone from $19 to $38 a month. Knowing that Michigan’s right-to-work law went into effect in March 2013, Allen informed the MEA in January 2014 that she wanted to end her membership.

That was no simple matter. She learned that she would still be forced to pay dues because the day before the right-to-work law went into effect, the union and the school board signed a so-called “union-security clause” deal that requires district employees to keep paying union dues or fees as a condition of employment. Since the right-to-work law applies only to union contracts signed after it went into effect, the deal requires Allen to keep paying the MEA until June 2018.

Her only option now is to become an “agency fee” payer, in which she is no longer a union “member,” but still has to pay a monthly fee. In most situations, a union will tell the employee that the agency fee is nearly the same as the dues. Many members don’t bother to change their status, because fee payers can no longer vote in union elections or on contracts, and they don’t think the modest savings are worth the trouble. Allen has inquired about being an agency fee payer, but has yet to receive information from the union.

The deal between the Lansing schools and Cook lets the union president collect a six-figure salary from a private organization but still vest in the state-run school pension system. The Lansing School District pays his salary and a contribution to his pension, and is reimbursed by the MEA. Currently, however, the pension-fund contributions that schools make do not cover the system’s ongoing underfunding, for which taxpayers remain on the hook. The extent to which some individuals are allowed to “spike” their benefits only contributes to that problem.

Cook worked as a teacher’s aide in the Lansing School District but phased out those duties when he was elected an MEA officer in 1991. The arrangement with district allows him to not only collect a public pension, but also collect one that will be based on his MEA salary, which exceeds $200,000. The pension system he is in is for “Michigan Public School Employees,” but the union and the district worked out an arrangement to allow an employee of a private organization to reap benefits, as well.

The deal is similar to an arrangement uncovered in Chicago in 2011, in which a union official was able to amass a $158,000 annual public pension by working one day on the city payroll.

“These cases clearly illustrate that the government unions are not here for the benefit of ‘the children’ much less the benefit of their own rank and file. The union bosses are hanging on for dear life to a system that keeps them in power and makes them rich at the expense of taxpayers,” said Rae Ann McNeilly, executive director of Taxpayers United of America.

Taxpayers United of America is a nonprofit organization that in 2006 began publishing data on the top state and municipal pensions throughout the country. It holds workshops to teach the media and the public how to get access to the data.

Allen believes the deal with Cook allows the district to buy leverage with the union at member expense.

“It is another slap in the face and even more reason to not trust the union or the district. Secretaries are severely underpaid and can’t afford to pay a union that doesn’t help us or answer our questions. And we especially shouldn’t have to pay a union that threatens and intimidates us,” said Allen.

The Lansing School District, the Lansing Schools Education Association and the MEA did not return calls and emails for comment.

Rae Ann McNeilly was quoted in an article by SaukValley.com about TUA’s study on Lee and Whiteside County pensions.

Political solutions usually have winners and losers.

Everybody is going to lose.

Or, at least, nobody is going to win.

That’s what happens when you can no longer ignore a $100 billion unfunded liability.

To be exact, $104.6 billion at the end of 2014.

And growing.

ILLINOIS VOTERS IN November added another name to the list of more than 11,000 government retirees who are drawing six-figure state pensions.

Pat Quinn, who lost his bid for re-election as governor, is now having to get by on his monthly state pension of nearly $11,400.

That’s the government retirement income he earned for 35 years in public life, which included being state treasurer, lieutenant governor, and – for the past 6 years – governor.

That calculates to $136,752 a year.

The anti-tax group Taxpayers United of America estimates that by 2025, more than 25,000 government retirees in Illinois will be drawing state pensions of at least $100,000 a year.

All legal. All proper. All above board.

But pretty ridiculous.

THAT’S THE BIG emotional argument.

The anti-tax, anti-union political forces want to make participants in the public pension systems the bad guys.

“Our study shows that Lee and Whiteside County taxpayers are still being robbed blind by government bureaucrats in the form of lavish, gold-plated pensions,” Rae Ann McNeilly, executive director of the Taxpayers United of America, said in a recent news release.

She called them “thieves,” comparing them to Rita Crundwell.

In fact, about two dozen retirees from local governments in Lee and Whiteside counties – most of them former educators – get pensions of more than $100,000 a year.

Hundreds of others in our community receive state pensions that exceed the average household income of working families in those two counties.

And the average retirement age for those state pensioners is under 60.

Then throw in a 3 percent annual increase – guaranteed – even if state revenues plummet and pension investments tank.

So a little populist demagoguery can easily make the public resent the pensioners.

After all, that money came from taxpayers.

REMEMBER SOME important things about those pensions.

Pensioners are not taking anything they are not legally entitled to have.

They contributed to those pensions, as did their public employers, and they should be expected to earn a reasonable return on investment of that money during the 30 or so years of their working life.

All benefits were obtained through state law or collective bargaining.

Democratic and Republican legislators have, over the years, been almost unanimous in voting to fatten and protect government pensions.

Democratic and Republican governors have negotiated contracts, including pension benefits, with public employee unions.

Unions have done a good job of looking out for the interests of their members.

But all of those players, apparently, ignored the realities of economics and math that make such a system unsustainable unless we unduly punish taxpayers or starve education, local governments, the prison system, and myriad other state programs and services.