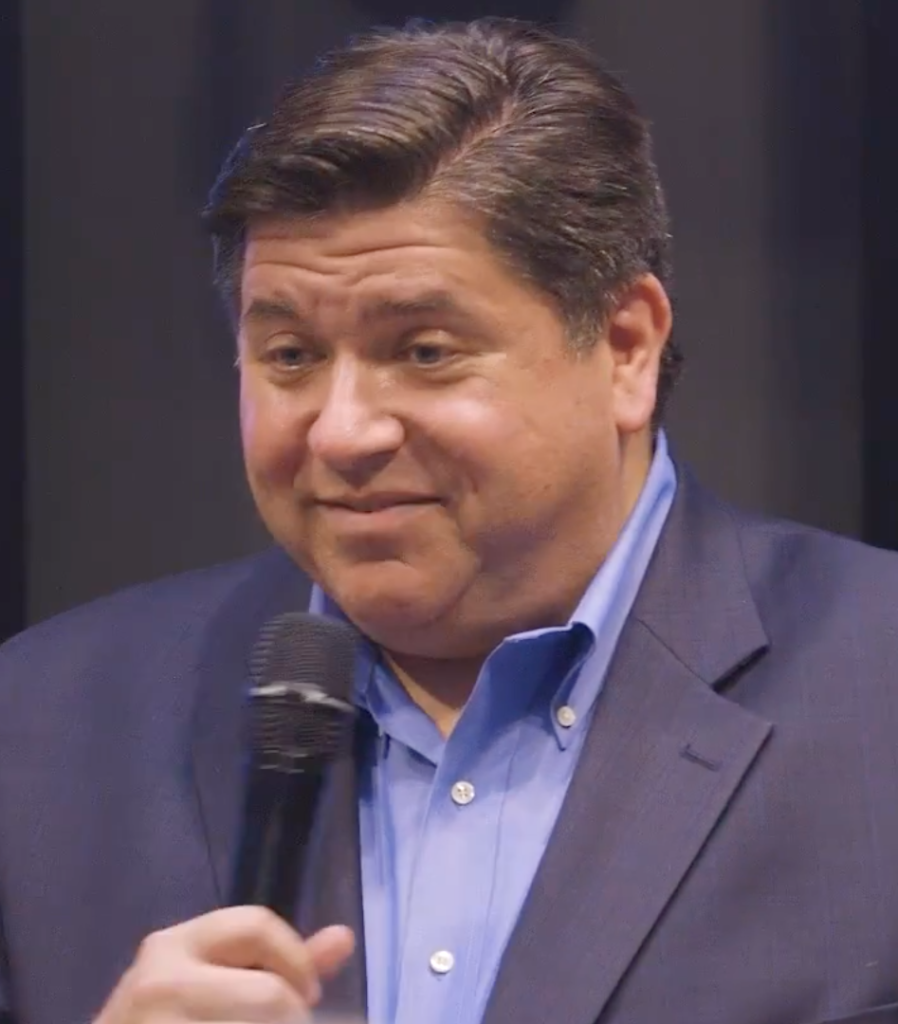

As Illinois inches closer to recession, Illinois Governor, Jay Robert “J. B.” Pritzker should look to the past to see how historical figures weathered similar crises. Unsurprisingly, tax increases are not a part of the solution.

In 1920, there was a much shorter depression than the one that started in 1929. In its initial stages, this depression was every bit as severe as the more famous one that would begin nine years later.

From 1920 to 1921, the estimated gross national product plunged 24% from $91.5 billion to $69.6 billion. During that same period, the number of unemployed people jumped from 2.1 million to 4.9 million or roughly 12% of the workforce. Home and farm foreclosures and bank failures spiraled, and calls for federal relief came from every corner of America.

Unlike Herbert Hoover and FDR, however, then-President Warren G. Harding had both the wisdom and the courage to resist these pressures. Harding understood that depressions were the unavoidable result of speculative bubbles created by monetary inflation.

There were no huge government bailouts to save failing businesses or banks, no grand federal make-work programs to employ the unemployed, no massive regulation of the economy to reign in the markets, stifle investment or impede trade.

To fight the recession, Harding called on Congress to dramatically reduce both taxes and spending. Federal spending was cut from $6.3 billion in 1920 to $5 billion in 1921 and to $3.2 billion in 1922. Federal taxes were also reduced from $6.6 billion in 1920 to $5.5 billion in 1921 and to $4 billion in 1922 with budget surpluses each year used to reduce the federal debt.

The results were astounding. By 1922, GNP had recovered to $74.6 billion and unemployment fell by nearly 50% to 2.8 million (6.7%)!

Today, Illinois stands on the brink of total economic collapse, and, yet, the Democrat Governor, Jay Robert “J. B.” Pritzker, has put on the November ballot an Income Tax Increase Amendment to the State Constitution that would saddle Illinois taxpayers with a huge state income tax increase.

The wisdom of Pres. Warren G. Harding is in very short supply in 2020. If Illinois is to survive as a viable governmental entity, taxpayers must send “J. B.” a message by voting down his November 3rd Income Theft Amendment. If that happens, hopefully our rotund governor will come to his senses and tell the state legislature that Illinois needs some badly-needed tax cuts.

Source:http://www.taxpayereducation.org/2010/06/warren-harding-and-the-great-depression-that-wasnt/