View as PDF

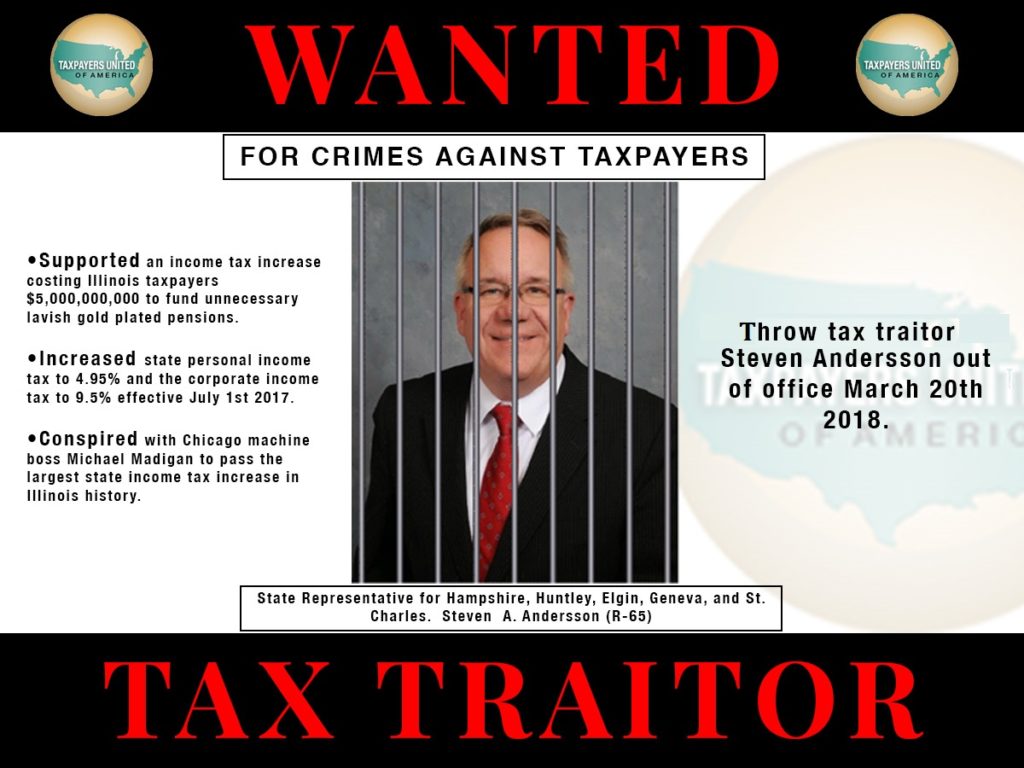

CHICAGO—Springfield Democrats enacted the largest permanent income tax hike in the state’s history, raising the personal income tax rate to 4.95 percent from 3.75 percent, and the corporate income tax rate from 7.75 percent to 9.5 percent, but they are just getting warmed up, warned Jim Tobin, President of Taxpayers United of America (TUA). In 2018, Ill. House Speaker and Chicago machine boss Michael J. Madigan (D-22, Chicago), and Ill. Senate President John J. Cullerton (D-6, Chicago), plan on putting on the statewide ballot a proposal to convert the state’s already high income tax to an even higher graduated income tax.

“If put on the ballot, this income tax increase amendment to the state constitution will be presented to Illinois voters, and I can assure you that all state government employees, active and retired, will vote ‘Yes’ on this measure,” said Tobin.

Taxpayers United of America’s executive director, Jared Labell, added, “But sensible Illinois taxpayers will defeat any such proposal if the spend thrift politicians in Springfield attempt to force this disaster upon us.”

“If approved, as with previous state tax increases, almost all of the money will be pumped into the insolvent state pension plans for retired state-government employees.”

“These retired state-government employees are enjoying lavish, gold-plated pensions, while a person in the private sector, who may not have a company pension at all, must scrape by with an average annual Social Security retirement benefit of less than $17,000,” said Tobin.

“Nearly 100,000 Illinois government retirees collect annual pensions totaling $50,000 or more, and 17,000 of those former government employees collect annual pensions totaling $100,000 or more. This is outrageous.”

“These Springfield Democrats need to be taught a lesson. Illinois taxpayers, including those in the Democrat stronghold of Cook County, must call and write their representatives in the Illinois House and Senate and voice their opposition to any further increases in the state income tax. They must tell these highway robbers that if they support changing the state income tax to a graduated income tax, they will be voted out of office,” said Tobin.

Labell concluded, “And if every democrat candidate running for governor continues to advocate for a new disastrous graduated income tax for Illinois, taxpayers will revolt and insure their defeat at the ballot box in 2018.”