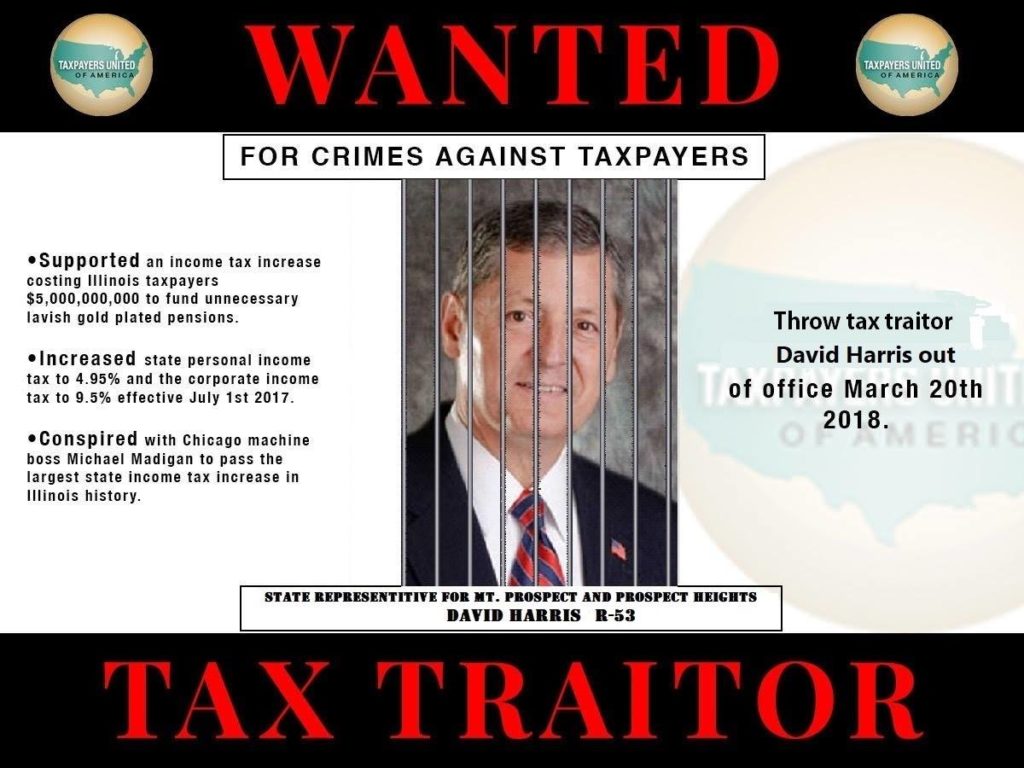

CHICAGO—The second Republican “Taxpayer Traitor” David Harris has been named on August 24, 2017, at the headquarters of Taxpayers United of America (TUA), 205 W. Randolph Street, Suite 1305,

The press conference was held after a TUA victory in Illinois House district 65. TUA helped oust Representative Steven A. Andersson from his current district. Representative Andersson was the last tax traitor to be named, and TUA takes rightful credit for ending his run as state representative.

“(Steven A. Andersson) is gone, that’s one down, and eight to go,” said Jim Tobin, TUA President.

Now TUA turns its attention to David Harris of district 53. David Harris was one of the Tax Traitors that sided with Michael Madigan, raising the personal income tax rate by 32% this last July. Shifting pressure onto David Harris, TUA will be utilizing new tactics that were deployed against Rep. Steven Andersson, and will increasing the intensity of their efforts.

“It’s a shame that these Republicans have betrayed their constituents, and Mr. Harris needs to be thrown out of office,” later stated Jim Tobin.

These Taxpayer Traitors have betrayed their constituents and must pay the price. TUA will continue to expose these Republican turncoats until all are gone. It’s time for a massive housecleaning in Springfield!

View Daily Herald News article featuring TUA!

Unsustainable Illinois Govt. Pensions Driving State to Bankruptcy

CHICAGO — Taxpayers United of America (TUA) today released the results of its 11th Annual Illinois State Pensions Report. This new report analyzes government retiree pensions from Illinois’ General Assembly Retirement System (GARS), Judges’ Retirement System (JRS), Teachers’ Retirement System (TRS), State Universities Retirement System (SURS), State Employees’ Retirement System (SERS), and the Illinois Municipal Retirement Fund (IMRF).

Click below to view the data from TUA’s 11th Annual Illinois State Pensions Report

- Illinois Government Pensions Exceeding $100,000 – nearly 17,000

- Top 200 State Universities Retirement System Pensions

- Top 200 Teachers’ Retirement System Pensions

- Top 200 State Empoyees’ Retirement System Pensions

- Top 200 General Assembly Retirement System Pensions

- Top 200 Judges’ Retirement System Pensions

- Top 200 Illinois Municipal Retirement Fund Pensions

Surveying the increasing number of government retirees and the growth of their pensions over the past few decades provides a greater understanding of the financial burden facing Illinois taxpayers. Nearly two years ongoing, Illinois’ current budget crisis is mainly due to the exorbitant costs of the government pension system supported by Democrats and Republicans like Illinois House Speaker Michael Madigan and former Gov. Jim Edgar. Government pension payments now devour billions of tax dollars every year to line the pockets of retired government employees.

TUA’s research exposes the magnitude of Illinois’ financial crisis by examining the vast number of retired government employees collecting lavish six-figure annual pensions. 17,000 former government employees each collect annual pensions of at least $100,000, costing taxpayers more than $2 billion this year alone.

Taxpayers work longer and receive far less in retirement than government employees, who often retire in their early 50s with taxpayer-funded pensions worth multiple times the annual maximum Social Security retirement benefit for taxpayers, which is $32,000 if working until 66.

Based on data collected through Freedom of Information Act (FOIA) requests, TUA’s analysis of Illinois government pensions reveals nearly 100,000 Illinois government retirees now collect annual pensions of $50,000 or more, an increase of more than 7,000 additional government retirees since TUA’s 2016 Annual Illinois State Pensions Report.

How much these pensioners paid into their own retirement, in contrast to their generous payouts, is shocking.

For many government retirees, within two years they will collect more money in retirement than they contributed to their own pension. These gold-plated government pensions, subsidized by taxpayers, accumulate to multi-million dollar payouts over a natural lifetime. Using this data to calculate the estimated lifetime pension payout totals for these government retirees underscores the ever-increasing liabilities of defined-benefit government pensions. The system is an untenable burden on taxpayers and increasingly consumes billions of tax dollars in the state budget, worsening with every new hire and retiree adding to the cost.

The Illinois State Constitution’s pension-protection clause – Article XIII, Section 5 – chains generations of taxpayers to an uncontrolled financial burden foolishly created decades ago by politicians in Springfield. It must be amended for a sustainable financial future. Taxpayers are unable to pay this enormous cost, as the budget crisis clearly shows, and without changes, taxpayers will otherwise continue to leave Illinois by the thousands for states with booming economies, while the tax burden increases for those remaining in Illinois.

View as PDF

East Peoria, IL – Taxpayers United of America (TUA) has released its most recent government pension study exposing individual pensions for Tazewell County government retirees, as well as Pekin municipal, Tazewell County and Tazewell County government schools, Illinois Central College, and Pekin police and fire retirees.

“There are more than 30 government teachers in Tazewell County collecting annual pensions in excess of $100,000. These lavish, gold-plated pensions all accumulate to $1 million to $5.2 million over a normal lifetime. These pensions are so rich for a number of reasons: 3% compounded cost of living increases, regardless of economic conditions, receiving full retirement benefits as early as 55 years old, taxpayer contributions that exceed teacher contributions by nearly four times,” said Jim Tobin, President of Taxpayers United of America (TUA).

Across the five state pension funds and the Illinois Municipal Retirement Fund (IMRF), there are more than 15,661 government pensioners collecting six-figure annual pensions and more than 92,386 retirees collecting over $50,000 annually and those pensions increase by 3% compounded every year for each of the pension funds, except IMRF. After about 20 years, the pension doubles, so government retirees make more in retirement than they made when employed.

The median household income across Tazewell County is only $57,052 and the poverty rate is 9.6%.

“In the private sector, taxpayers are forced to pay 15% into Social Security for every dollar they earn, receiving an average annual pension of only $16,000! And yet for every dollar that government pensioners contribute to their own pensions, taxpayers are forced to pay $3.76. Imagine what kind of nest-egg taxpayers would have if we were allowed to invest what we are forced to pay into Social Security and the Illinois State government pension systems,” added Tobin.

“This should serve as a glaring warning to taxpayers who are concerned about their rising property taxes, as cities like Pekin and East Peoria in Tazewell County are forced, by law, to raise property taxes without a referendum to fund IMRF pensions,” said Tobin. “It’s legal plunder of hardworking taxpayers for the benefit of the political class.”

“The top estimated lifetime pension in this study of Tazewell County government retirees is $6,644,309. And the lucky recipient of this rich pension is John Erwin who retired from Illinois Central College with an annual pension of $188,064. His personal investment in this wealthy outcome is only about 4.8%.”

“The top annual pension award in Tazewell County goes to Thomas Thomas who, like John Erwin, retired from Illinois Central College at the age of 60. His current annual pension payment is $205,979. These annual payments will accumulate to about $4,872,095. His contributions constitute about 3% of this multi-million dollar payout.”

Click to view the complete list of the following:

- Tazewell County Government Retirees

- Tazewell County Government School Retirees

- Pekin Municipal Government Retirees

- Pekin Police Retirees

- Pekin Fire Retirees

- Illinois Central College Retirees

“Tazewell County taxpayers need to fire all incumbent bureaucrats on November 8 who have voted to perpetuate this economically devastating system that benefits the few at great expense to the many,” said Tobin.

“Fixing this system is basically easy, but will never happen as long as those who are entrenched in its benefits remain in office: Transitioning new hires to 401(k)-style defined contribution pension plans would be a good start to halting the growth of the problem. As for the current unfunded liabilities, allowing municipalities, school districts, and other taxing districts to reorganize through Chapter 9 bankruptcy, or pursuing federal legislation to preempt the Illinois Constitution’s pension-protection clause, are both becoming very real possibilities if systemic reforms aren’t pursued soon,” said Tobin.

TUA’s most recent 10th Annual Illinois State Pensions Report contains additional data concerning the state’s government pension crisis and elaborates on further solutions to this long-term problem. Check out our list of 218 Illinois referenda to see if you are facing a local tax-increase referendum on November 8.