View as PDF

Rockford, IL – Taxpayer Education Foundation (TEF) today released its updated study on Rockford-area government pensions including the top 200 pensions in the Teachers Retirement System (TRS), Illinois Municipal Retirement Fund (IMRF), and the State University Retirement System (SURS). Based on the TEF pension study, Taxpayers United of America (TUA) issued the following statement:

“IMRF pensions, largely kept afloat by property taxes of homeowners and businesses, hit Rockford taxpayers particularly hard. Rockford is right up there with New York and New Jersey. With the fourth highest property taxes in the entire country, Rockford is especially burdened by an effective tax rate of 2.83%,” said Jim Tobin, president of TUA.

“For many homeowners, this

means that their property taxes meet or exceed their actual mortgage payment,

although this is financially detrimental to every property owner in Rockford.”

“We have passed the point

where the government bureaucrats who made these outrageous promises can tax

their way out of the problem, although they will try their damndest. This is

why Springfield Democrats have put on the 2020 statewide ballot the Income Tax

Increase Amendment.

Cook County

machine Democrat, Gov. Jay Robert “J. B.” Pritzker and his buddy, Chicago

Machine Boss, Michael J. Madigan, Democrat Speaker of the Illinois House, are

hoping to keep propping up the pension system by increasing the income tax

under the guise of a ‘more fair’ graduated state income tax.”

“I guarantee that the middle

class will be hit the hardest by the Income Tax Increase Amendment, as well

as all of the new and higher taxes they are implementing.”

- Click

here to see the top 200 Rockford TRS pensions

- Click

here to see the top 200 Rockford and Winnebago County IMRF pensions

- Click

here to see the top Rockford SURS pensions

“Rockford taxpayers, because of their

comparatively high property tax rate, will be hit harder by the Pritzker Income

Tax Increase Amendment than most Illinoisans.”

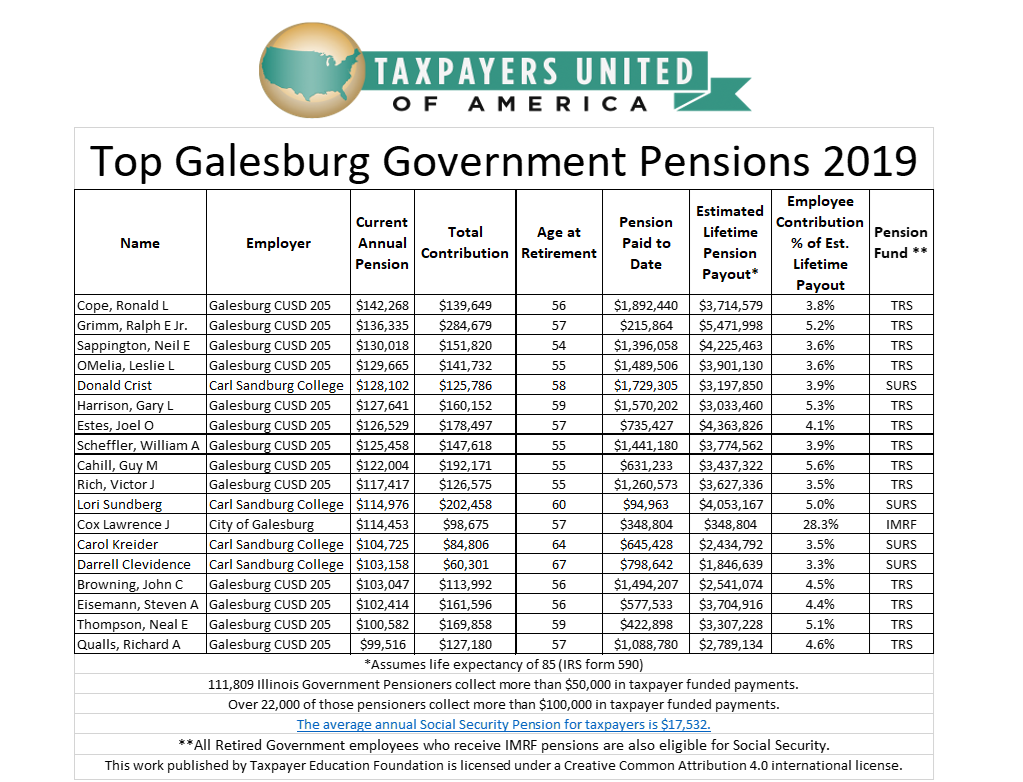

“When you look at what the

individual government retirees are actually collecting in taxpayer funded

pensions, you can get a better idea of why this theft of taxpayer wealth is so

egregious. Keep in mind that the average taxpayer will collect only about $17,500

a year from Social Security, and that IMRF pensioners are also eligible for a

Social Security pension.”

Paul A. Logil retired from

the Winnebago County government and collects an annual

pension of $168,424. He retired at the age of 55 and paid $224,614 into the

IMRF. His estimated lifetime pension payout is approximately $4,329,741. Paul

is also eligible for a social security pension.

Alan S. Brown retired from

Rockford SD205 at the age of 55. His current annual pension is $183,329. He

paid only $175,892 into TRS and his estimated lifetime payout is $5,321,315.

Karl Jacobs retired from Rock Valley

College. His current annual

pension of $179,592 is more than the $159,281 he paid into SURS. His estimated

lifetime pension payout is $2,833,620.

“What is most troubling about

the pension crisis is that none of the elected bureaucrats are willing to do

anything to fix the problem. Speaker Madigan obviously is hoping to prop this

system up just long enough for him to retire, and escape all responsibility for

the financial demise of Illinois.

“All Illinois government new hires should be

placed in a 401(k) style retirement savings account beginning immediately, and

the retirement age should be increased to 65. These measures would at least slow

the bleeding until comprehensive pension reform can be enacted,” said Tobin.