View as PDF

Chicago – Taxpayer Education Foundation (TEF) today released its annual report of the State Employees’ Retirement System (SERS). Each year TEF obtains updated information on SERS retiree pension payments through the Freedom of Information Act (FOIA) requests directly from the SERS administrators. That data combined with information from the SERS annual report and the Illinois statutes governing the pension system provide the information necessary to calculate estimated lifetime pension payouts for current pensioners. Expected lifetimes are based on IRS form 590 actuarial tables. All statements and analyses are based on these data.

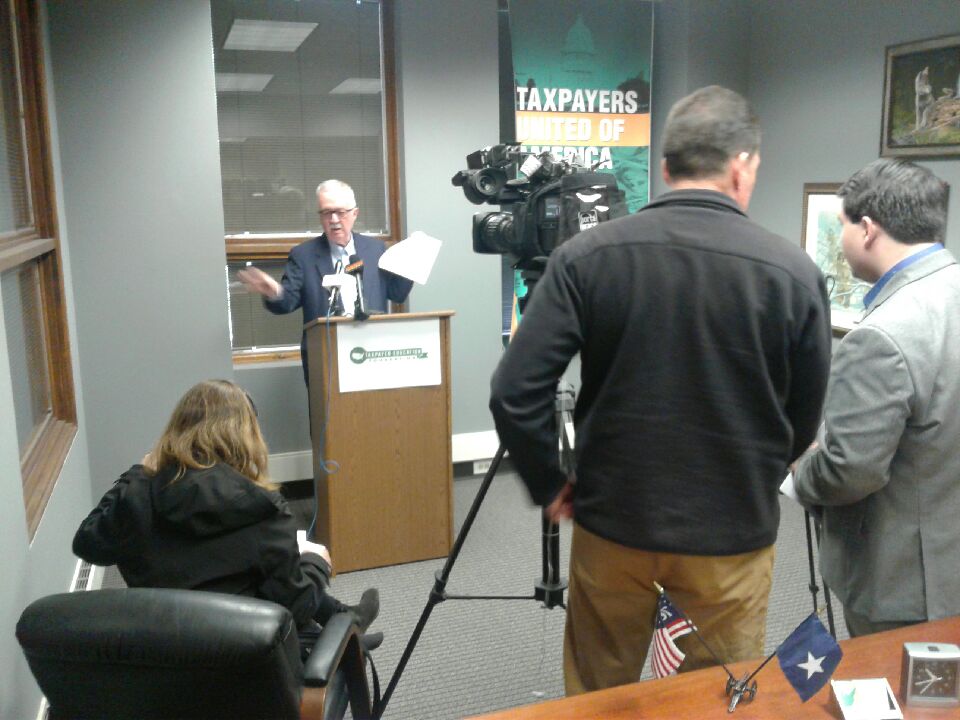

“SERS is another example of the state’s inability to live up to the pension promises made to the current 72,005 SERS payees in the third largest statewide fund,” said Jim Tobin, TEF president.”

“Like all of the government-employee pension funds in the state, SERS is bound by law to keep unrealistic promises made to government employees, but it is taxpayers who are forced to fund them. For every $1.00 that SERS members deposited into their own pension funds last year, taxpayers were forced to deposit $7.15.”

By contrast, private sector employees are required by law to deposit a combined 15% of their earnings and employer profits into Social Security for an average annual Social Security pension of about $17,000 if they work at least 32 years and retire at 66 while the SERS counterparts average $34,381 annually for only 24 years of eligible employment and the average age of retirement is 59. SERS pensioners are guaranteed an annual 3% compounded cost of living adjustment (COLA) regardless of market conditions. Social Security COLA is always limited to the consumer price index. The 2018 SS COLA is 2%.

“Illinois is functionally bankrupt. Yes, ‘bankrupt’ is the generally accepted term for the financial state of not having the capacity to meet one’s financial obligations. Across the state, services are being cut because Illinois statute requires pensions to be paid before other obligations and we can’t afford both. Illinois is bankrupt and bloated government pensions are the cause.”

“Here are just the top 5 pensions from SERS.

| Name | Current Annual Pension | Age at Retirement | *Estimated Lifetime Pension Payout | Employee Contribution % of Lifetime Payout |

| PARWATIKAR, SADASHIV D | $220,267 | 64 | $3,799,680 | 3.2% |

| MODIR, KAMAL | $199,087 | 60 | $4,091,811 | 2.5% |

| VALLABHANENI, NAGESWARARAO | $169,830 | 61 | $3,326,371 | 4.8% |

| BAIG, MIRZA S | $166,605 | 56 | $4,812,251 | 2.6% |

| KADKHODAIAN, HOOSHMAND | $162,843 | 61 | $3,306,561 | 5.4% |

Click here to see the top 200 SERS pensions

“It is mathematically impossible for Illinois to tax its way out of the pension promises corrupt politicians traded for votes, but that won’t stop the greedy Springfield thieves from trying. Moves are already under way to get a graduated income tax on the ballot, and basic services will be held hostage to ensure they get the votes needed to pass it.”

“Illinois has the highest out-migration in the country right now and we are on pace to lose another congressional district when the 2020 census is concluded. We are bleeding productive taxpayers, which only worsens our problems because there are fewer of us to carry the burden of higher taxes and higher interest on borrowing.”