Peoria, IL – Taxpayers in Peoria City and County are crushed by taxes new and old. The county’s new public safety pension tax only increases the tax burden without solving the mounting pension cost to taxpayers.

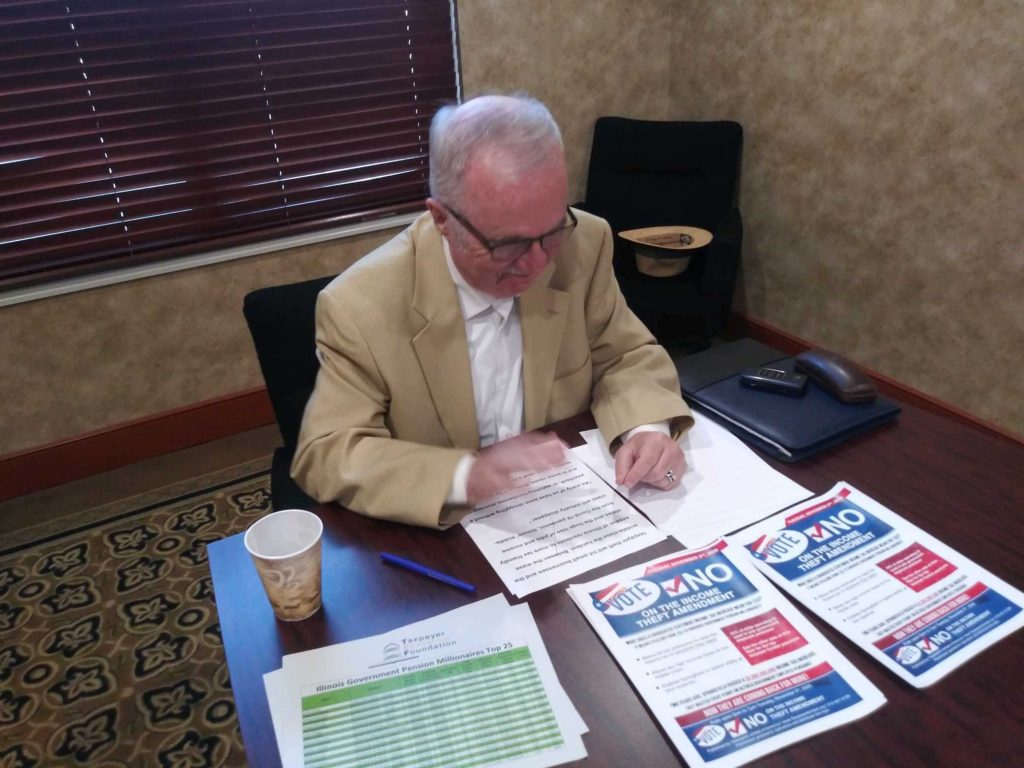

“Peoria government bureaucrats do nothing to solve the pension problems facing its taxpayers,” said Jim Tobin, president of Taxpayers United of America (TUA). “Like all the other taxing bodies in Illinois, all 7,000 of them, Peoria continues to treat its taxpayers like an ATM. Rather than do away with some government jobs, eliminate redundancies, cut expenses, and lobby the state legislature to put a pension reform amendment on the ballot, they just demand taxpayers fork over more cash.”

“While the local pensions of the Illinois Municipal Retirement Fund (IMRF) are paid by property taxes, the remaining five state pension funds are paid primarily with the Illinois state income-tax.”

“In order to fund pensions of the 148,654 pensioners who will collect more than a million dollars in pension payments, Democrat Gov. Jay Robert ‘J. B.’ Pritzker is seeking to adopt a constitutional amendment that will allow a graduated income tax that ushers in massive state income-tax increases. And that 148,654 doesn’t even include pensions from the hundreds of police and fire funds or the Chicago pension funds.”

“Pritzker’s income theft amendment will be on the November 3, 2020 ballot. If passed, this taxpayer theft will hit small businesses and the middle-class the hardest. Between the mass exodus of Illinois residents to more tax friendly states and the huge loss of jobs and income from the Covid-19 pandemic, Illinois’ middle-class will virtually disappear.”

“As many of us have been struggling without a paycheck, or watching businesses disintegrate and in some cases, destroyed by rioters and looters, here’s what a few of the political elite in Peoria County collected without a concern of what is to come:

Kevin W. Lyons retired from Peoria County government at the age of 55. His current annual pension is $151,401, an increase of about $3,600 over last year. With his 3% COLA, he will receive about $4,593,916 over a normal lifetime. His personal investment in that stunning payout is only about 4.4%. He is also eligible for a social security pension.

Roger M. Bergia, Peoria Heights CUSD 325 retiree, has a current annual pension of $249,372. His raise this year was about $7,200 and he will collect about $2,484,295 in estimated lifetime pension payments.

Thomas Thomas retired from Illinois Central College and currently collects $231,819 a year from the State University Retirement System (SURS). That’s an increase of about $6,700 over last year. His estimated lifetime payout is $4,839,817. He had to invest only $148,054 of his own money for that payout.”

“Illinois government employees only work 20.1 years on average in order to collect these unrealistic pensions. And for every dollar they deposit in their own pension fund, taxpayers are forced to fork over $4.74. Add to that a 3% COLA, compounded for all but IMRF, and it doesn’t take a genius to understand why Illinois’ government pensions are insolvent.”

“Rather than put an income theft amendment on the ballot, Pritzker should have pushed for a pension reform amendment because these outrageous pensions are protected by the state constitution,” said Tobin.