Roselle- “It’s unconscionable that taxpayers are footing the bill for excessively generous salaries and pensions and finding those they hire put their children in the hands of unscrupulous administrators and predatory teachers and coaches,” stated Matthew Schultz, executive director of Taxpayers United of American (TUA).

“Taxpayers tragically trust the tax-raisers when they are told that paying more for salaries and benefits will result in higher quality ‘educators’ and administrators and better outcomes for their students. They certainly don’t expect so much scandal for their money.”

LPHS Coach Jared Wissmiller was convicted for his sexual relationship with a 15 year old student. Years later, LPHS volunteer coach Frank Battaglia was found to be a convicted sexual offender. Battaglia’s background was covered up by principal Dominic Manola, athletic director Pete Schauer and coach Chris Roll. This all came to light during an investigation into athletic recruiting violations.

“Manola, who was earning $122,004 plus $20,385 in benefits; Schauer, who was earning $152,149, and Roll who was earning $125,610 all returned to work after a brief suspension. These rich salaries translate to excessively rich pensions,” added Schultz.

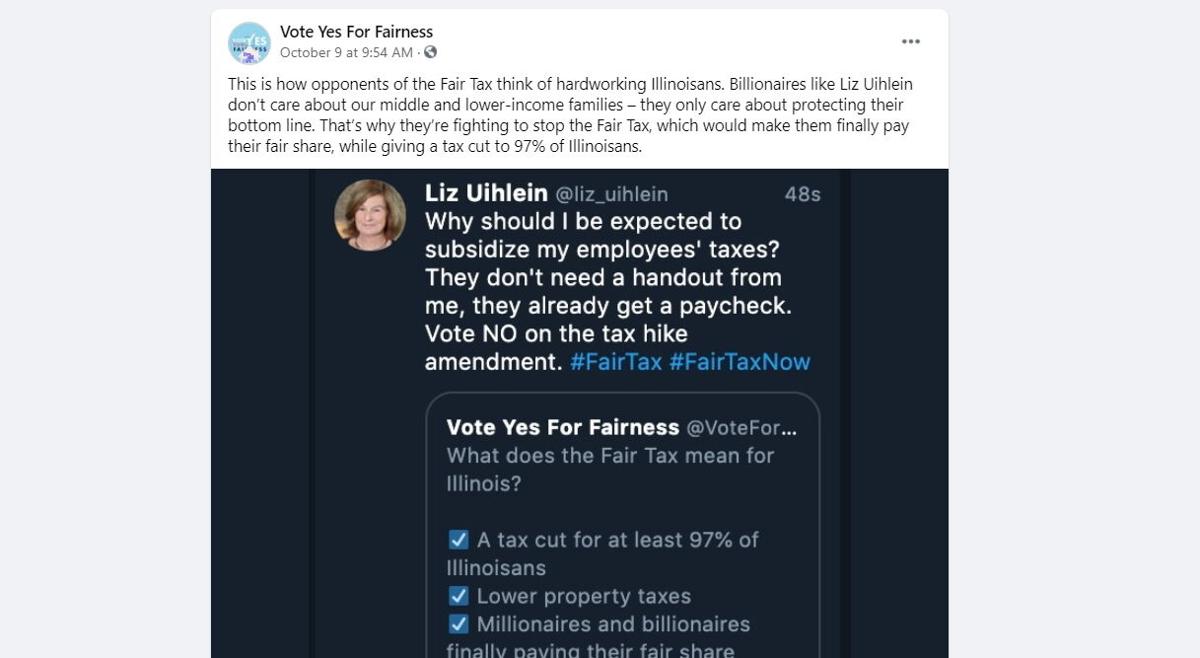

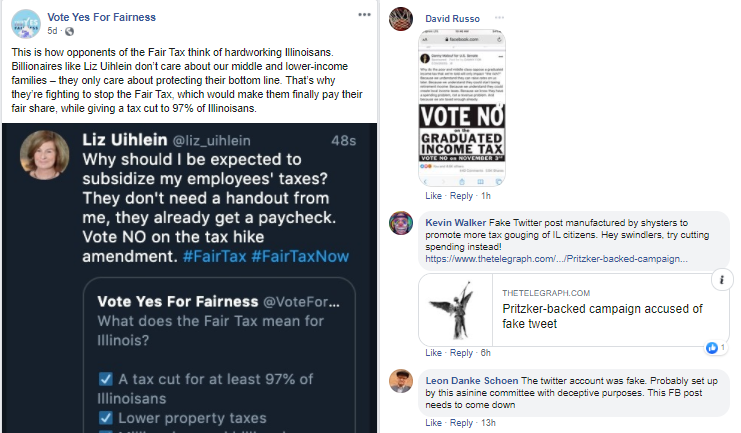

“The Teachers Retirement System (TRS) is only about 50% funded. Guess who is on the hook for the other 50%? Taxpayers can’t afford to overpay teachers in employment and then another 30 years in pensions. But apparently Gov. J. B. Pritzker didn’t get that memo. He is working very hard, even putting in his own money, to get a graduated income-tax amendment passed.”

“Pritzker’s graduated income-tax will decimate middle-class Illinoisans. It’s never a good idea to raise taxes, but in the midst of the Covid-19 economic downturn it’s just plain crazy.”

“Here is a closer look at what Pritzker’s income-tax increase is really about: Government Pensions. Regardless of how they perform in their government jobs that come with nearly iron-clad job security, as you can see from the LPHS examples, these government teachers can retire early and collect obscene amounts of money from taxpayers.”

“David W. Smith retired from Lake Park CHSD 108 at only 58 years old. His current annual pension is $192,367. With his 3% compounded cost of living adjustment (COLA) he will collect about $4,446,485 over a normal lifetime.”

“Edward J. Wardzala was only 55 when he retired from Lake Park CHSD 108. With 30 years of compounded COLAs, Wardzala will collect at least $5,928,305 in taxpayer funded pension payments. His current annual pension is a very generous $179,996! Click Here to view top Roselle government teacher pensions.

“It’s bad enough that government teachers are overpaid, regardless of performance, while they are teaching. It is tragic that we continue to pay them excessively throughout their retirement,” concluded Schultz.