A recent article in the Hinsdale-Clarendon Hills Patch revealed that retired Hinsdale SD 181 elementary Supt. Mary Curley receives an annual pension of an astounding $315,336, and that this enormous pension was made possible by two 20 percent raises in her final two years.

See: https://patch.com/illinois/hinsdale/ex-hinsdale-official-gets-315k-pension

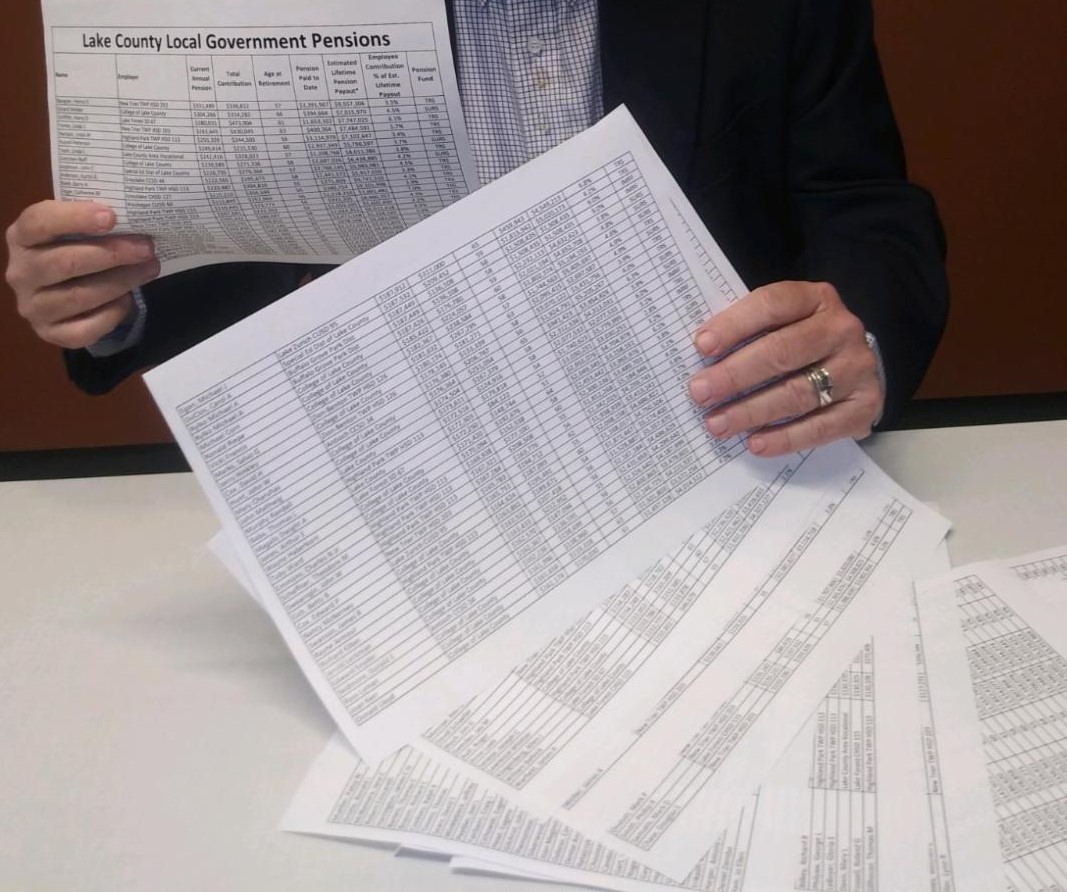

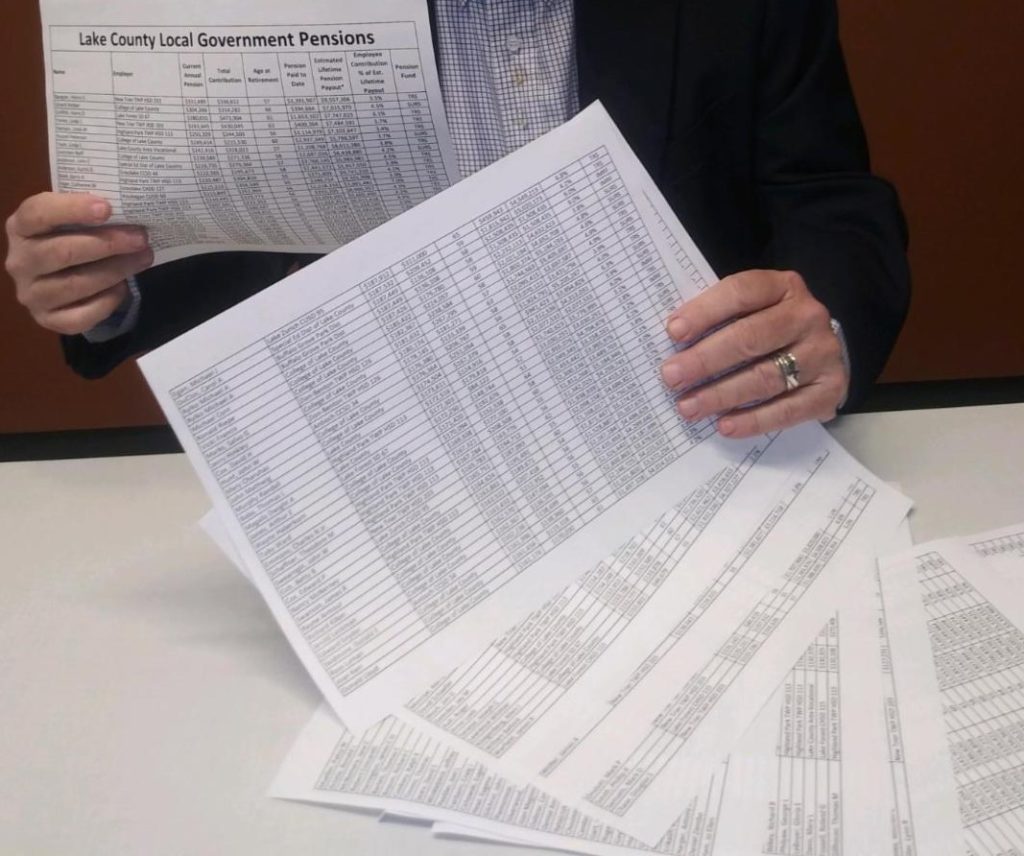

“Curley retired at 55 after 34 years with the district,” said Jim Tobin, president of Taxpayers United of America (TUA). “For years, many districts granted superintendents and teachers two 20 percent raises in their last two years. Finally, the state legislature passed a law limiting end-of-career spiking to 6 percent annually in the last four years, which is still a huge amount.”

“This egregious example is just the tip of the iceberg. Retired government school bureaucrats and teachers in Illinois are receiving lavish, gold-plated pensions and benefits that enable them to enjoy luxurious lifestyles while the state’s government pension funds have become functionally bankrupt.”

“To make matters worse, Illinois taxpayers have had their state income taxes raised by a substantial amount so that their hard-earned dollars can be pumped into the floundering government pension funds.”

“While the average Social Security pension for taxpayers is $17,532, our Taxpayer Education Foundation’s (TUA) research shows that 111,809 Illinois Government Pensioners collect more than $50,000 in taxpayer funded payments, and over 22,000 of those pensioners collect more than $100,000 in taxpayer funded payments. This is outrageous.”

“Retired government employees who receive IMRF pensions, one of the state’s six government pension plans, are subsidized with our property taxes. They also are eligible for Social Security payments!”

“It doesn’t take a genius to figure out why the state’s government pension plans are effectively bankrupt, and why the state itself is going under as it tries to save these funds with more taxpayer dollars. Springfield politicians must now bite the bullet and consider an amendment to the Illinois Constitution to enable pension benefits to be lowered.”

“In the meantime, taxpayers must defeat all property tax increase referenda on the March 17 primary ballot.”

“Finally, it’s crucial that taxpayers vote against the Income Theft Amendment that Gov. Jay Robert ‘J. B.’ Pritzker put on the November 3 ballot.

Click here to view the 2019 overview of the six major Illinois pension funds.