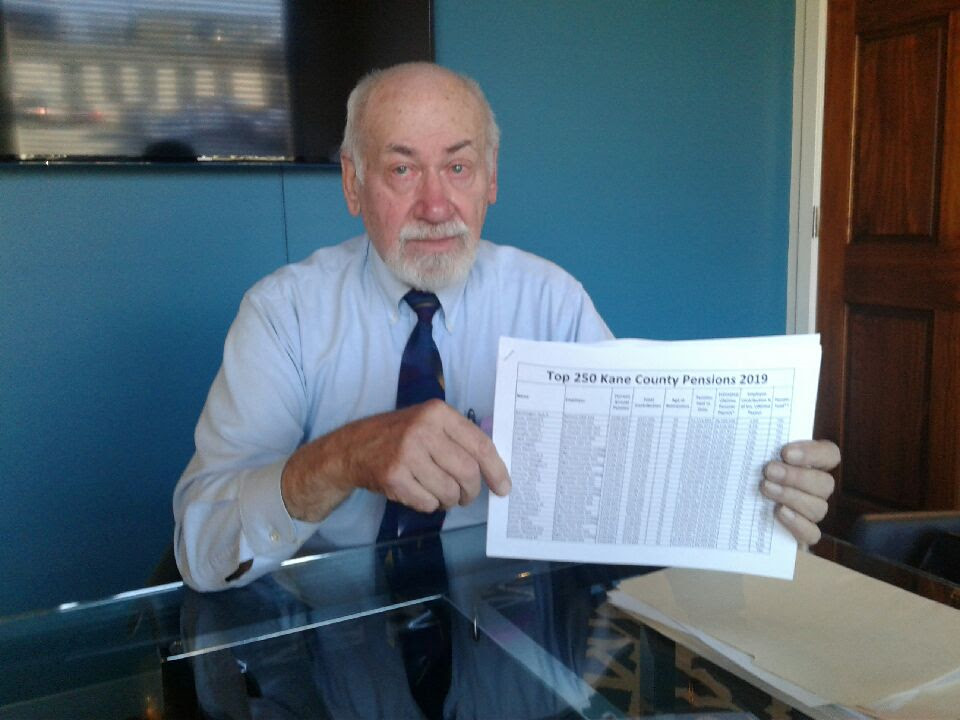

GENEVA, IL – “Taxpayer Education Foundation (TEF) released today its updated study on Kane County area government-employee pensions. The study includes pensioners from the Teachers Retirement System (TRS), the State University Retirement System (SURS), as well as pensioners in the Illinois Municipal Retirement Fund (IMRF).”

“Kane County taxpayers are much smarter than the government bureaucrats who tyrannically tax them,” said Val Zimnicki, TUA Director of Outreach. “Rather than cut spending, these government bureaucrats only have one solution, and that is just to keep increasing taxes.”

“It is no mystery what is driving economy-killing property taxes increases in this county. One word: pensions. IMRF pensions are funded with property taxes, and state law requires that the IMRF pension bill is paid before all other bills. Taxpayers currently pay $3 in property taxes for every $1 that IMRF members pay into their own retirement fund. Their property taxes have nothing to do with roads, services, or children. Who receives these benefits? The privileged government class.”

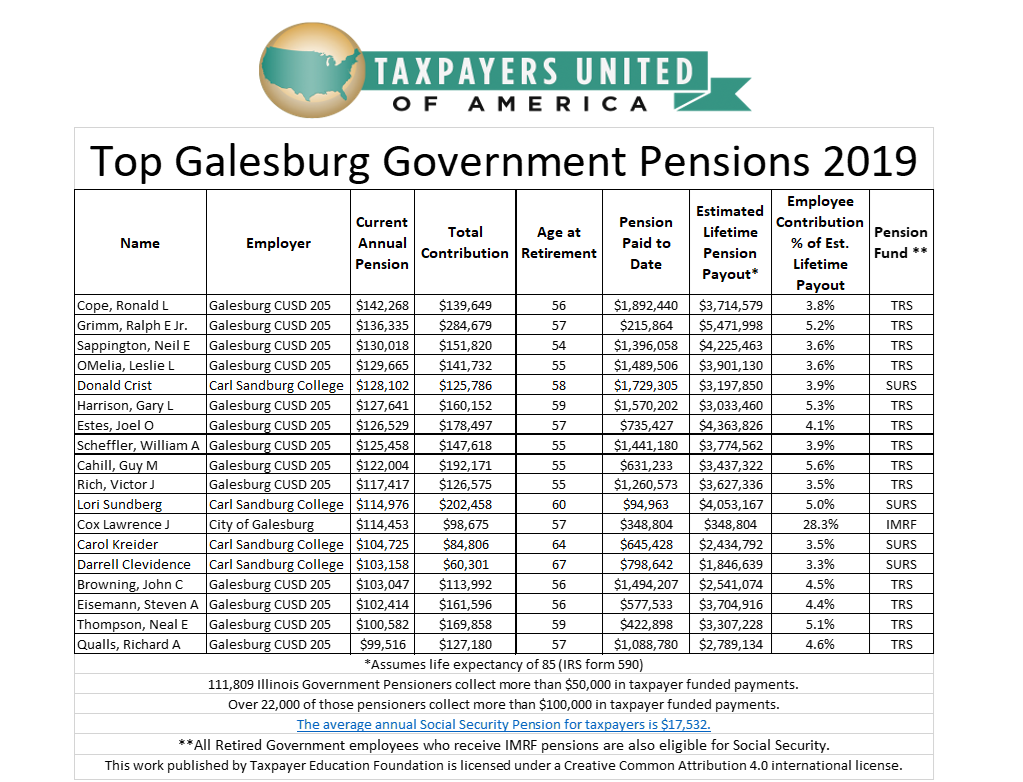

“The average social security recipient gets about $17,500 a year. IMRF pensioners can also receive social security.”

“Jack Barshinger retired from the teachers union at age 59. His current annual pension is $258,825. His lifetime expected payout will be $8,269,596.”

“Nick Mavros retired at age 56. His annual SURS pension of $164,171 will accumulate to a total of $4,680,872.”

“Another gold-plated pensioner is Larry Maholland, who was employed by the city of St. Charles. He retired at the ripe old age of 59 and receives $147,218 per year from his IMRF pension. His estimated lifetime payout is $1,757,705.”

Click HERE to view top 250 Kane County government pensions.

“The entire local and statewide pension system in Illinois is unsustainable. While property taxes fund the IMRF, the other 5 statewide pension funds are funded by the state income tax. Governor Jay Robert ‘J. B.’ Pritzker and his tax-raising bureaucrat cronies will try to stick it to the middle class by increasing the state income tax under the guise of a fairer graduated income tax. There is nothing fair about this tax. If it passes, legislators will take away power from Illinois citizens and give it to the tax raisers. When the state goes under, the tax raisers will be long gone.”

“Illinois is functionally bankrupt, and the cause is runaway government employee pensions with unfunded liabilities so huge that it is mathematically impossible for the state and its municipalities to tax their way out of this financial black hole.”

“Wirepoints states that Illinois is the nation’s extreme outlier when it comes to pension shortfalls. The state has a $241 billion shortfall in its five state-run pension funds, according to Moody’s. Illinois’ pension spending equals 28 percent of the state’s GDP.”

“All Illinois government new hires should be placed in 401(k) style retirement savings accounts beginning immediately, and the retirement age should be raised to 67,” said Zimnicki.

“The long-term solution to Illinois’ fiscal woes is for the state to formally declare bankruptcy. This would have to be authorized by Congress, and I believe Congress would do so.”

“While we’re waiting for this necessary measure, the state of Illinois can help its citizens by passing a law to enable any local government to declare bankruptcy. Springfield should also cut state taxes to stimulate its sluggish economy.”